We Are

AltPayNet.

In a world of fast-moving technology and digitalization,

AltPayNet is at the forefront of providing solutions in

digital payments.

The Best of BredTM Technologies

Global Partnerships

Best

Practices

Who is

AltPayNet?

AltPayNet is a Global Digital Payments Solutions Provider, dedicated to creating, enhancing, and enriching your online payments with solutions catered to your company’s needs. Whatever you need, AltPayNet delivers.

We provide...

Software as a Service (Saas)

Third Party Payment Processing

Cybersecurity Solutions

Fraud and Risk Management

Payment

Gateway Technology

Mobile Banking Solutions

Remittance Solutions

Software as a Service (SaaS)

Whitelabel Mobile and Web Applications for different sectors and business units developed to assist operations and online payment collection.

Third-Party Payment Processing

Easy access to a multitude of payment methods used by consumers from around the world. See list of Alternative Payment Methods here.

Cybersecurity Solutions

Secure and compliant payment channels give you peace of mind and confidence that your information is safe in any context.

Fraud and Risk Management

An extra layer of protection for your online transactions that allows you to be in full control of your processing activities.

Payment Gateway Technology

Connectivity to a wide collection of payment services from around the world to stay connected to your growing market.

Mobile banking Solutions

Pay from the convenience of your mobile phone with easy-to-use, accessible and on-the-go payment solutions.

Remittance Solutions

Cost-efficient and Compliant remittance solutions to facilitate cross border transactions.

Borderless payments

Limitless Connections

Our partner network assures you that you can always count on our technology to get you to your customers, no matter how your company performs payments.

Versatile, customizable, and secure

Payment Solutions

AltPayNet’s software products and services provide its clients with the power of choice. Our various white-label solutions hand you the reins on how to take your business to the next level.

Card Scheme Acquirer

Payment Gateway

E-Invoicing

Property Management

Crowdfunding Platform

Consulting / Back Office

Our tailor-made solutions are easy to use, fast to process, and secure. No matter your requirement, we have a tailor-made solution for you.

Recent

Insights

Inside the PULSE Engine

Smarter Loyalty Rewards for Digital-First Banks

PULSE Loyalty Software delivers smarter loyalty rewards for digital-first banks and e-commerce platforms, turning customer engagement into lasting loyalty.

Ten Years of Breaking Barriers in Payments

A Decade of Innovation with AltPayNet

Celebrate AltPayNet’s 10th anniversary and discover how a decade of innovation has empowered the Filipino diaspora with secure, inclusive, and scalable digital payment solutions.

Crunchfish Offline Payment Solution to Enter the Philippines

AltPayNet’s CEO Don Vacal made his first Sibos appearance as a speaker for a Fireside Chat, where he highlighted the need for versatile payments service across rural communities in the Philippines.

Crunchfish and AltPayNet spotlight offline payment solutions at Sibos 2025, showcasing resilient fintech innovations for the Philippines.

How PULSE Loyalty Software is Redefining Customer Rewards in the Philippines

Beyond AltPayNet's suite of white-label payment software is a new product unveiled. One that's stronger and bolder, built to automate systems for vouchers, cashbacks, rewards, and other loyalty programs for digital-first banks and financial institutions in the Philippines.

Whether you’re a bank, fintech, or enterprise, PULSE Loyalty Software offers the most comprehensive loyalty marketing platform in the Philippines. From digital vouchers to AI-driven loyalty personalization, it’s the ultimate customer engagement and rewards platform designed for the financially-savvy Filipino market. Build stronger relationships, increase retention, and drive growth with a digital loyalty platform that truly understands your needs.

Fintech for Good: Cleaning Up Outdated Payment Systems in the Philippines

It’s no secret that there’s a lot of unscrupulous, under the table deals within our local government agencies. But 2025 is the year where huge leaps are being taken to finally replace these outdated payment systems. New technologies, after all, offer transparency and better payment security. This promotes accountability for all parties involved in the payments and disbursement process.

It’s no secret that there’s a lot of unscrupulous, under the table deals within our local government agencies. But 2025 is the year where huge leaps are being taken to finally replace these outdated payment systems. New technologies, after all, offer transparency and better payment security. This promotes accountability for all parties involved in the payments and disbursement process.

The Case for White-Label Payment Gateways

Discover how white-label payment gateways can help businesses scale faster, cut costs, and launch globally—without the heavy lifting of building from scratch.

Discover how white-label payment gateways can help businesses scale faster, cut costs, and launch globally—without the heavy lifting of building from scratch.

From Cash to Code: How the Philippines Is Catching Up on Digital Payments

See how fintech players are working in tandem with Philippine regulators, banks, and government agencies to turn cash into code — building online payment systems that are accessible, fast, and compliant.

See how fintech players are working in tandem with Philippine regulators, banks, and government agencies to turn cash into code — building online payment systems that are accessible, fast, and compliant.

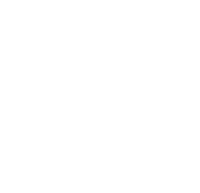

No Website Needed for Online Payments: e-Invoicing for Hospitality and Travel Industry

This innovative e-invoicing white-label payment platform is designed to revolutionize how hospitality businesses handle payments, regardless of their size or digital presence.

This innovative e-invoicing white-label payment platform is designed to revolutionize how hospitality businesses handle payments, regardless of their size or digital presence.

Cybersecurity Best Practices: Key Takeaways from AltPayNet’s Security Awareness Training

Learn how to prevent phishing attacks, implement strong password policies, secure mobile devices, and protect your business from cyber threats. Stay ahead with expert insights on incident response, social engineering, and AI-driven security risks.

Discover key cybersecurity best practices from AltPayNet’s Security Awareness Training. Learn how to prevent phishing attacks, implement strong password policies, secure mobile devices, and protect your business from cyber threats. Stay ahead with expert insights on incident response, social engineering, and AI-driven security risks.

Understanding Anti-Money Laundering (AML): Key Takeaways from Our AML Orientation

What role does Anti-Money Laundering or AML play in the world of online payments and fintech? Our Head of Compliance Leah Aba simplified the terms for us, so we can all effectively work towards combatting these illegal transactions for AltPayNet white-label payment products and merchant services.

What role does Anti-Money Laundering or AML play in the world of online payments and fintech? Our Head of Compliance Leah Aba simplified the terms for us, so we can all effectively work towards combatting these illegal transactions for AltPayNet white-label payment products and merchant services.

Why Traditional Banks Need a White-Label Payment Gateway to Stay Ahead

Here's why traditional banks must adopt a white-label payment gateway to stay competitive. Neobanks or digital banks may be popular, but traditional banks can grow strategically by outsourcing seamless, branded payment solutions that will greatly enhance customer experience, and future-proof their banking operations.

Traditional banks risk falling behind neobanks without a white-label payment gateway. Discover how adopting a white-label payment gateway can enhance customer experience, boost efficiency, and drive digital transformation.

Remittance Revolution for OFWs: Why the Philippines Needs Affordable and Centralized Solutions

Discover how outdated remittance systems in the Philippines impact millions of OFWs and local financial institutions. Learn about the challenges, opportunities, and the urgent need for affordable and centralized online payment solutions for Overseas Filipinos.

Discover how outdated remittance systems in the Philippines impact millions of OFWs and local financial institutions. Learn about the challenges, opportunities, and the urgent need for affordable, centralized payment solutions for Overseas Filipinos.

Online Payments and Financial Inclusion Programs for the Philippines’ Unbanked

Learn how Bangko Sentral ng Pilipinas’ online payments initiatives are helping small businesses and the unbanked in the Philippines.

Learn how Bangko Sentral ng Pilipinas’ online payments initiatives are helping small businesses and the unbanked in the Philippines.

Open Banking is Gaining Traction: How far will it go?

Open banking is changing financial services worldwide, and the way consumers are accessing their account data and making payments will never be the same.

Customer Service Statement of AltPayNet

June 26, 2021

This statement is issued by ALTPAYNET Corp. (“ALTPAYNET”) as a global third-party payment processor, and a principal member acquirer of various card brands, which is working with Flexewallet Pty Ltd (“Flexewallet”) to...

The Beginner’s Guide to eCommerce Security and Compliance

August 20, 2020

Protect your business from fraud, scams, and disputes. Learn the importance of security, and how to process your eCommerce compliances in this article.

COVID-19 Led Digital Transformation in eCommerce

First Published on May 13, 2020 Updated on July 18, 2023

How can businesses in eCommerce and Financial Technology adapt to the COVID-19 -led digital transformation? Cost-efficiency, convenience, and sustainability — that’s what all these FinTech innovations are for. It’s about making things easier for people and businesses.

AltPayNet Now an Acquirer of Diners and Discover Cards

March 29, 2020

Discover Global Network, the payments brand of Discover Financial Services, has certified the acquiring status of AltPayNet as an Acquirer. This enables AltPayNet to provide their clients — payment companies, banking institutions and merchants the worldwide acceptance of Discover, Diners Club International, and affiliate network cards.

AltPayNet: A PCI DSS Level 1 Certified Service Provider

July 08, 2019

These requirements apply not just with payment service providers like AltPayNet, but also to their clients processing credit card data. The compliance levels vary per annual transaction volume. If you are a small organization with less than 20,000 credit card transactions per year, your business may fall under Level 4.

How Payment Gateways Protect Your Business from Fraudulent Transactions?

June 03, 2019

Online fraud may not be a problem for startups processing only a few transactions each day. However, as your business grows and card transactions become the norm, ignoring the risks can turn into a terribly expensive mistake. In fact, according to Statista, US merchants suffered an estimated loss of 6.4 billion dollars in payment card fraud in 2018.

AltPayNet a Recognized Cybersecurity Assessment Provider Under the DICT

May 10, 2019

Data security in the Philippines is only growing stronger, thanks to the companies that hold it with utmost importance. One of the main drivers to this undertaking is the Republic Act No. 10844, which stipulates that the Department of Information and Communications Technology (DICT) must warrant the security of Critical Information Infrastructure (CII).

Online Payments Guide for Startups: No Integration Payment Methods

April 22, 2019

The number of digital buyers worldwide continues to rise. Competitive prices and high-quality products do attract shoppers and drive them to add items to their cart, but it’s only the start of the buyer’s journey. The final purchasing decision rests on the trust and the available payment options once they hit the checkout button. Money transfers should be easy and accessible.

New Payment Platform Powers Five-Star Hotel

February 22, 2019

The first week of its launch saw a new payment platform raking in huge transaction volume for a five-star hotel in Makati. The platform is called e-Snapped, created by online payment gateway and multi-solutions SaaS provider AltPayNet. A first of its kind in the country, it is an e-Invoicing that provides a simple and secure way to collect receivables online.

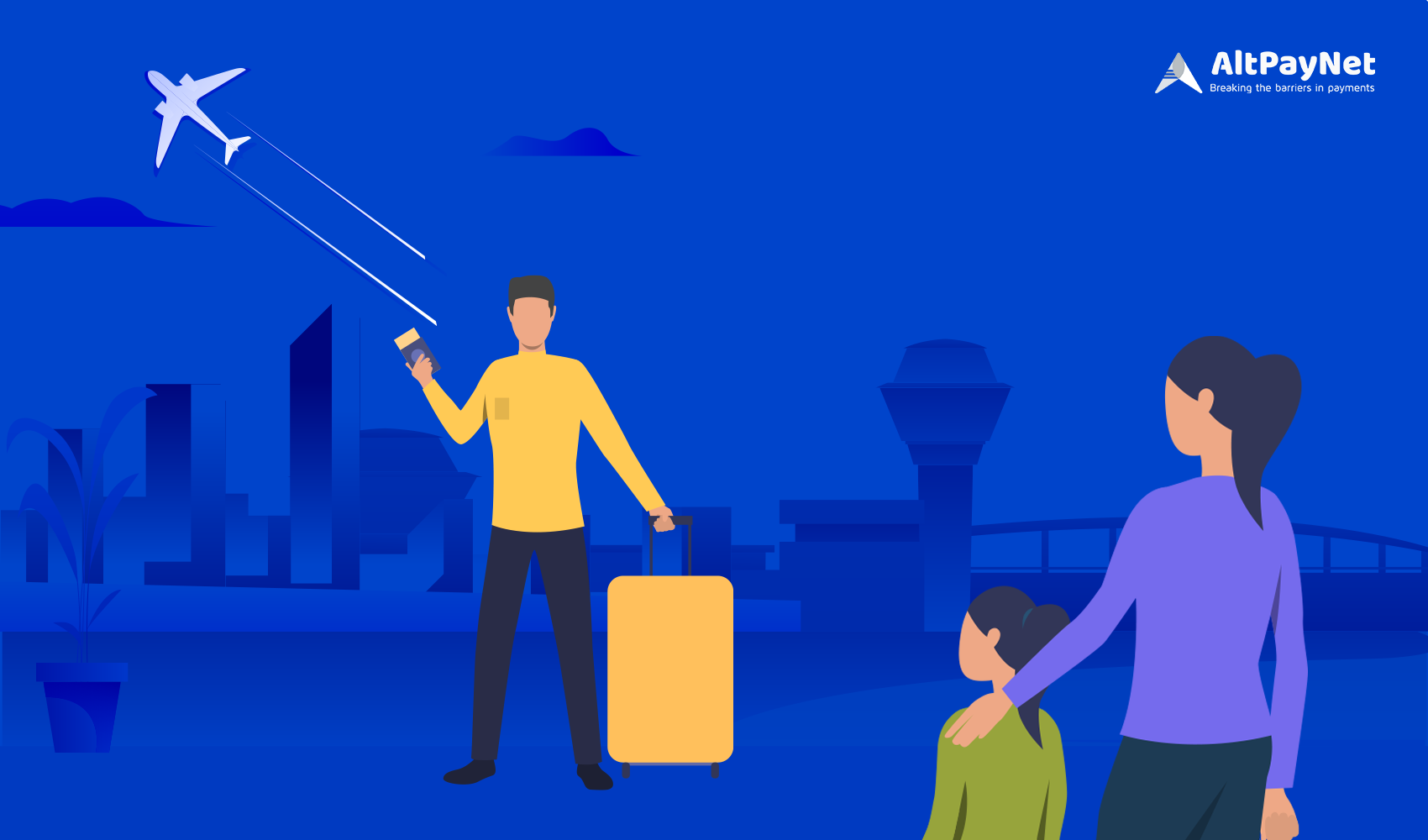

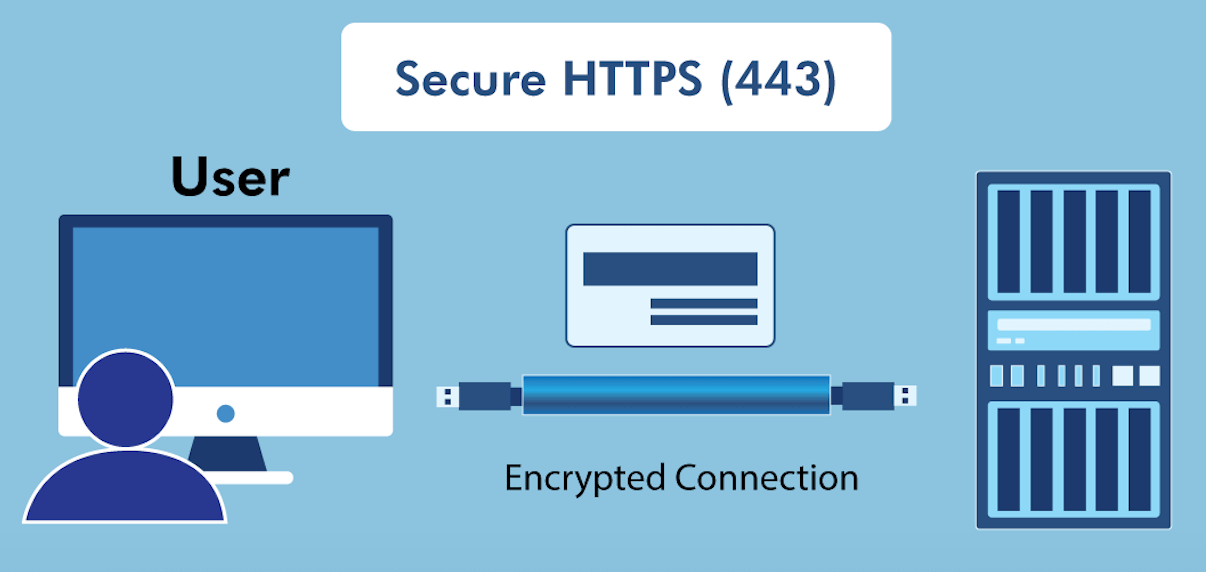

Why is HTTPS Important?

December 10, 2018

We always come across the acronym HTTPS when browsing websites, and getting redirected for online payments. Now it’s time to get to know its role in the world wide web, and why it matters.

How to Use Bitcoin for Online Payments?

October 08, 2018

Bitcoin is accepted globally, but there’s no need for exchange rates, bank fees, or dual-currency billing. It crosses boundaries and is less volatile than cash. It has since been likened to gold because unlike cash, there is no means of duplicating cryptocurrency. In fact, Bitcoin is now the most sought-after currency as its value increases everyday. It is scarce, not easily corruptible, secure, and immune to inflation.

How to Choose the Right Payment Gateway?

May 07, 2018

Like everything else, a business thrives in having a firm foundation. A foundation that’s made up of well thought-out decisions, paving way for cost-effective implementations, efficient business processes, and effective strategies. Laying these groundworks are crucial, as they can be the biggest money makers or deterrents for growth. And for online businesses, one big decision to start with is finding the right payment gateway. Luckily, there’s a lot of information online you can read up on. And to make it simple, we’ve come up with a comprehensive guide on how to choose the right payment gateway provider. These seven (7) points will help you find the right payments partner in no time.

What is a Payment Gateway?

March 21, 2018

Given the rise of tech startups and businesses keeping up with the online world, a new concern has been going around boardrooms and meetings: “We need a Payment Gateway.” Out of these discussions, the fundamental question, “What exactly is a Payment Gateway, and why do we need one?” needs to be addressed.

Being Start-up CEO

August 24, 2017

A company’s heart is its CEO. Leading startups is probably the hardest task and it is always shouldered by the founder. You start from scratch, and from the scratch, you’ll try to bring something out. ALTPAYNET is not an exception to that. With their fast-paced improvement, there are underlying facts that should be uncovered. Luckily, I was able to have the opportunity to do that. Now, let’s take a look at how Mr. Don Vacal, the CEO of ALTPAYNET gets by.

On Hiring Rockstar Interns

October 18, 2016

Internship Programs offer hands-on opportunity for students to work on their chosen field or industry. It lets student interns to try-out working and handling roles and responsibilities and at the same time being mentored by industry experts...

5 E-Commerce Challenges Every Merchant Faces

June 10, 2016

The e-Commerce industry is rapidly hitting its numbers and definitely moving fast. It is seen in the global growth in the online sales across the UK, US and around the world...

Recruitment, A Key Challenge For A Start-Up And Some Job Opportunities In Our Makati Office

January 09, 2016

Starting a new company entails a lot of challenges which include primarily hiring the best, the ambitious and the most reliable team members. Having previously started a company, I have recruited the best and the mediocre...

Inside the PULSE Engine

Smarter Loyalty Rewards for Digital-First Banks

PULSE Loyalty Software delivers smarter loyalty rewards for digital-first banks and e-commerce platforms, turning customer engagement into lasting loyalty.

Ten Years of Breaking Barriers in Payments

A Decade of Innovation with AltPayNet

Celebrate AltPayNet’s 10th anniversary and discover how a decade of innovation has empowered the Filipino diaspora with secure, inclusive, and scalable digital payment solutions.

Crunchfish Offline Payment Solution to Enter the Philippines

AltPayNet’s CEO Don Vacal made his first Sibos appearance as a speaker for a Fireside Chat, where he highlighted the need for versatile payments service across rural communities in the Philippines.

Crunchfish and AltPayNet spotlight offline payment solutions at Sibos 2025, showcasing resilient fintech innovations for the Philippines.

How PULSE Loyalty Software is Redefining Customer Rewards in the Philippines

Beyond AltPayNet's suite of white-label payment software is a new product unveiled. One that's stronger and bolder, built to automate systems for vouchers, cashbacks, rewards, and other loyalty programs for digital-first banks and financial institutions in the Philippines.

Whether you’re a bank, fintech, or enterprise, PULSE Loyalty Software offers the most comprehensive loyalty marketing platform in the Philippines. From digital vouchers to AI-driven loyalty personalization, it’s the ultimate customer engagement and rewards platform designed for the financially-savvy Filipino market. Build stronger relationships, increase retention, and drive growth with a digital loyalty platform that truly understands your needs.

Fintech for Good: Cleaning Up Outdated Payment Systems in the Philippines

It’s no secret that there’s a lot of unscrupulous, under the table deals within our local government agencies. But 2025 is the year where huge leaps are being taken to finally replace these outdated payment systems. New technologies, after all, offer transparency and better payment security. This promotes accountability for all parties involved in the payments and disbursement process.

It’s no secret that there’s a lot of unscrupulous, under the table deals within our local government agencies. But 2025 is the year where huge leaps are being taken to finally replace these outdated payment systems. New technologies, after all, offer transparency and better payment security. This promotes accountability for all parties involved in the payments and disbursement process.

The Case for White-Label Payment Gateways

Discover how white-label payment gateways can help businesses scale faster, cut costs, and launch globally—without the heavy lifting of building from scratch.

Discover how white-label payment gateways can help businesses scale faster, cut costs, and launch globally—without the heavy lifting of building from scratch.

From Cash to Code: How the Philippines Is Catching Up on Digital Payments

See how fintech players are working in tandem with Philippine regulators, banks, and government agencies to turn cash into code — building online payment systems that are accessible, fast, and compliant.

See how fintech players are working in tandem with Philippine regulators, banks, and government agencies to turn cash into code — building online payment systems that are accessible, fast, and compliant.

No Website Needed for Online Payments: e-Invoicing for Hospitality and Travel Industry

This innovative e-invoicing white-label payment platform is designed to revolutionize how hospitality businesses handle payments, regardless of their size or digital presence.

This innovative e-invoicing white-label payment platform is designed to revolutionize how hospitality businesses handle payments, regardless of their size or digital presence.

Cybersecurity Best Practices: Key Takeaways from AltPayNet’s Security Awareness Training

Learn how to prevent phishing attacks, implement strong password policies, secure mobile devices, and protect your business from cyber threats. Stay ahead with expert insights on incident response, social engineering, and AI-driven security risks.

Discover key cybersecurity best practices from AltPayNet’s Security Awareness Training. Learn how to prevent phishing attacks, implement strong password policies, secure mobile devices, and protect your business from cyber threats. Stay ahead with expert insights on incident response, social engineering, and AI-driven security risks.

Understanding Anti-Money Laundering (AML): Key Takeaways from Our AML Orientation

What role does Anti-Money Laundering or AML play in the world of online payments and fintech? Our Head of Compliance Leah Aba simplified the terms for us, so we can all effectively work towards combatting these illegal transactions for AltPayNet white-label payment products and merchant services.

What role does Anti-Money Laundering or AML play in the world of online payments and fintech? Our Head of Compliance Leah Aba simplified the terms for us, so we can all effectively work towards combatting these illegal transactions for AltPayNet white-label payment products and merchant services.

Why Traditional Banks Need a White-Label Payment Gateway to Stay Ahead

Here's why traditional banks must adopt a white-label payment gateway to stay competitive. Neobanks or digital banks may be popular, but traditional banks can grow strategically by outsourcing seamless, branded payment solutions that will greatly enhance customer experience, and future-proof their banking operations.

Traditional banks risk falling behind neobanks without a white-label payment gateway. Discover how adopting a white-label payment gateway can enhance customer experience, boost efficiency, and drive digital transformation.

Remittance Revolution for OFWs: Why the Philippines Needs Affordable and Centralized Solutions

Discover how outdated remittance systems in the Philippines impact millions of OFWs and local financial institutions. Learn about the challenges, opportunities, and the urgent need for affordable and centralized online payment solutions for Overseas Filipinos.

Discover how outdated remittance systems in the Philippines impact millions of OFWs and local financial institutions. Learn about the challenges, opportunities, and the urgent need for affordable, centralized payment solutions for Overseas Filipinos.

Online Payments and Financial Inclusion Programs for the Philippines’ Unbanked

Learn how Bangko Sentral ng Pilipinas’ online payments initiatives are helping small businesses and the unbanked in the Philippines.

Learn how Bangko Sentral ng Pilipinas’ online payments initiatives are helping small businesses and the unbanked in the Philippines.

Open Banking is Gaining Traction: How far will it go?

Open banking is changing financial services worldwide, and the way consumers are accessing their account data and making payments will never be the same.

Customer Service Statement of AltPayNet

June 26, 2021

This statement is issued by ALTPAYNET Corp. (“ALTPAYNET”) as a global third-party payment processor, and a principal member acquirer of various card brands, which is working with Flexewallet Pty Ltd (“Flexewallet”) to...

The Beginner’s Guide to eCommerce Security and Compliance

August 20, 2020

Protect your business from fraud, scams, and disputes. Learn the importance of security, and how to process your eCommerce compliances in this article.

COVID-19 Led Digital Transformation in eCommerce

First Published on May 13, 2020 Updated on July 18, 2023

How can businesses in eCommerce and Financial Technology adapt to the COVID-19 -led digital transformation? Cost-efficiency, convenience, and sustainability — that’s what all these FinTech innovations are for. It’s about making things easier for people and businesses.

AltPayNet Now an Acquirer of Diners and Discover Cards

March 29, 2020

Discover Global Network, the payments brand of Discover Financial Services, has certified the acquiring status of AltPayNet as an Acquirer. This enables AltPayNet to provide their clients — payment companies, banking institutions and merchants the worldwide acceptance of Discover, Diners Club International, and affiliate network cards.

AltPayNet: A PCI DSS Level 1 Certified Service Provider

July 08, 2019

These requirements apply not just with payment service providers like AltPayNet, but also to their clients processing credit card data. The compliance levels vary per annual transaction volume. If you are a small organization with less than 20,000 credit card transactions per year, your business may fall under Level 4.

How Payment Gateways Protect Your Business from Fraudulent Transactions?

June 03, 2019

Online fraud may not be a problem for startups processing only a few transactions each day. However, as your business grows and card transactions become the norm, ignoring the risks can turn into a terribly expensive mistake. In fact, according to Statista, US merchants suffered an estimated loss of 6.4 billion dollars in payment card fraud in 2018.

AltPayNet a Recognized Cybersecurity Assessment Provider Under the DICT

May 10, 2019

Data security in the Philippines is only growing stronger, thanks to the companies that hold it with utmost importance. One of the main drivers to this undertaking is the Republic Act No. 10844, which stipulates that the Department of Information and Communications Technology (DICT) must warrant the security of Critical Information Infrastructure (CII).

Online Payments Guide for Startups: No Integration Payment Methods

April 22, 2019

The number of digital buyers worldwide continues to rise. Competitive prices and high-quality products do attract shoppers and drive them to add items to their cart, but it’s only the start of the buyer’s journey. The final purchasing decision rests on the trust and the available payment options once they hit the checkout button. Money transfers should be easy and accessible.

New Payment Platform Powers Five-Star Hotel

February 22, 2019

The first week of its launch saw a new payment platform raking in huge transaction volume for a five-star hotel in Makati. The platform is called e-Snapped, created by online payment gateway and multi-solutions SaaS provider AltPayNet. A first of its kind in the country, it is an e-Invoicing that provides a simple and secure way to collect receivables online.

Why is HTTPS Important?

December 10, 2018

We always come across the acronym HTTPS when browsing websites, and getting redirected for online payments. Now it’s time to get to know its role in the world wide web, and why it matters.

How to Use Bitcoin for Online Payments?

October 08, 2018

Bitcoin is accepted globally, but there’s no need for exchange rates, bank fees, or dual-currency billing. It crosses boundaries and is less volatile than cash. It has since been likened to gold because unlike cash, there is no means of duplicating cryptocurrency. In fact, Bitcoin is now the most sought-after currency as its value increases everyday. It is scarce, not easily corruptible, secure, and immune to inflation.

How to Choose the Right Payment Gateway?

May 07, 2018

Like everything else, a business thrives in having a firm foundation. A foundation that’s made up of well thought-out decisions, paving way for cost-effective implementations, efficient business processes, and effective strategies. Laying these groundworks are crucial, as they can be the biggest money makers or deterrents for growth. And for online businesses, one big decision to start with is finding the right payment gateway. Luckily, there’s a lot of information online you can read up on. And to make it simple, we’ve come up with a comprehensive guide on how to choose the right payment gateway provider. These seven (7) points will help you find the right payments partner in no time.

What is a Payment Gateway?

March 21, 2018

Given the rise of tech startups and businesses keeping up with the online world, a new concern has been going around boardrooms and meetings: “We need a Payment Gateway.” Out of these discussions, the fundamental question, “What exactly is a Payment Gateway, and why do we need one?” needs to be addressed.

Being Start-up CEO

August 24, 2017

A company’s heart is its CEO. Leading startups is probably the hardest task and it is always shouldered by the founder. You start from scratch, and from the scratch, you’ll try to bring something out. ALTPAYNET is not an exception to that. With their fast-paced improvement, there are underlying facts that should be uncovered. Luckily, I was able to have the opportunity to do that. Now, let’s take a look at how Mr. Don Vacal, the CEO of ALTPAYNET gets by.

On Hiring Rockstar Interns

October 18, 2016

Internship Programs offer hands-on opportunity for students to work on their chosen field or industry. It lets student interns to try-out working and handling roles and responsibilities and at the same time being mentored by industry experts...

5 E-Commerce Challenges Every Merchant Faces

June 10, 2016

The e-Commerce industry is rapidly hitting its numbers and definitely moving fast. It is seen in the global growth in the online sales across the UK, US and around the world...

Recruitment, A Key Challenge For A Start-Up And Some Job Opportunities In Our Makati Office

January 09, 2016

Starting a new company entails a lot of challenges which include primarily hiring the best, the ambitious and the most reliable team members. Having previously started a company, I have recruited the best and the mediocre...

Interested? Feel free to drop a message

or inquire about our company!