Blog and Updates

Online Payments Guide for Startups: No Integration Payment Methods

April 22, 2019

By: Tania M. Voss

e-Invoicing

Payment Platform, e-Invoicing

Digital Invoicing

e-Snapped

The number of digital buyers worldwide continues to rise. According to Statista, there were 1.66 billion digital buyers in 2017. That’s a lot of potential customers. And for your online store to thrive in the fiercely competitive e-commerce industry, you need to provide your customers the convenience and flexibility they demand. After all, consumers prefer to buy online for the wide product selection, affordable prices and time-saving delivery.

Competitive prices and high-quality products do attract shoppers and drive them to add items to their cart, but it’s only the start of the buyer’s journey. The final purchasing decision rests on the trust and the available payment options once they hit the checkout button. Money transfers should be easy and accessible.

If you’re selling online, we’ve compiled a list of the top payment solutions and how they work to help you move your business forward.

PayPal

With more than 257 million active accounts globally, PayPal ranks second to bank cards as the preferred online retail payment method in North America, Latin America, Western Europe, and Australia. PayPal promises fast and secure money transfers that benefit both buyers and sellers.

For users making a purchase online, they can fund and send their payment in several ways: by instantly deducting the amount from their account balance, by linking their credit card, or by writing an e-Check.

For merchants, payment can be received within minutes. Advanced encryption and round-the-clock transaction monitoring ensure security, and PayPal’s Seller Protection helps prevent financial losses on qualified transactions. Tools are available for multiple staff access, business performance measurement, and monthly reports.

As for the downside, one can argue that PayPal transaction fees are a pain, but there are also ways to reduce them, such as transferring your balance to your bank account before withdrawal. Funds may also be put on hold for newbies, but as soon as you establish a reputable selling history, you can then freely access your money. You just need to check the overall cost of payment acceptance to having your money in your bank account.

e-Snapped

e-Snapped is new to the game, having only launched late last year. The service allows for electronic invoicing, without the need for integration or a website. The merchant sends the invoice to clients or business partners via e-mail. The client then receives the invoice with the purchase details in the body of the email message. Like a real paper invoice, only that it has a pay button the customers can click, and they are redirected to e-Snapped’s secure payment site.

The e-Snapped platform is also personalized for each merchant which the logo appears in the merchant dashboard and the invoice header payment page. Merchants can monitor every invoice sent: From ensuring the invoice is in order, the due date is set, if the email with the invoice is received, if the customer rejected the invoice, or if the payment has been executed but failed to go through, or the invoice is duly paid.

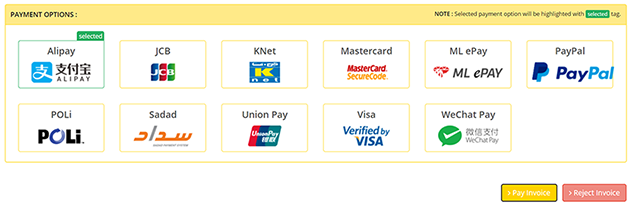

Since the e-Snapped platform is anchored in a strong payment gateway, it has the widest payment methods of 450+ global payment institutions. Furthermore, it allows for real-time reversals, refunds and rebills. This is a straightforward world-class e-Invoicing that can be integrated to ERPs and accounting platforms.

This solution is best for transaction-heavy merchant categories such as the hospitality industry, professional organizations, academic institutions and service industries. It also works for start-ups, as it simplifies payment acceptance, even when the merchant’s website is still under construction.

Currently, e-Snapped accepts most payment networks available, such as Visa, MasterCard, JCB, Diners, American Express, wechat, Alipay, China UnionPay, Poli of Australia and New Zealand, SEPA of Europe and bank transfers from the Middle East region.

Stripe

Although Stripe should not be in the list as this payment solution requires integration to the seller’s website, it is important to note that its greatest advantage is giving customers the power to pay using their credit cards without the business-to-bank hassle. For sellers, setting it up only requires integration with their website.

If you have knowledge in coding and want to build a custom user experience, Stripe’s free and simple API lets you tailor your e-commerce store according to your business needs, whether you’re aiming for a subscription service or a crowdfunding program. No in-house developers? Stripe can help you work with other e-commerce platforms to build your desired environment.

Stripe, however, doesn’t support PayPal payments and many other payment methods.

Amazon Pay

Amazon Pay lets you make Amazon’s customers your own! Amazon account holders can readily pay for a purchase on your e-Commerce site using the information stored in their existing Amazon.com accounts. This way, they’re using a payment channel they already know and trust, protected under Amazon’s A-to-Z Guarantee, improving buyer confidence and winning customers who are unwilling to share their credit card details.

Amazon Pay also supports the customer’s local currency and is available in multiple languages, helping your business reach more people. Furthermore, it provides tools for shipping and sales tax configuration, customized promotion creation, order management, and co-branding.

Customers shop online for the convenience, and they want to pay for their purchases with ease. However, not all payment methods are created equal.

At ALTPAYNET, we offer secure and seamless payment solutions to help your business grow. We help you also determine the total cost of processing. Contact us to learn more.

Sources:

https://www.statista.com/topics/2411/paypal/

https://www.statista.com/statistics/251666/number-of-digital-buyers-worldwide/

https://www.paypal.com/ph/webapps/mpp/home

https://stripe.com

http://www.harapartners.com/blog/amazon-payments-magento/

online-payments-guide-for-startups